How to Stop Repossession of Your Home

"*" indicates required fields

The threat of losing the family home is one that worries thousands of homeowners up and down the country every year. Unfortunately, repossession can hit any of us and latest government data shows that in Q1 of 2024 repossessions were 4% up on the same quarter in the prior year. Perhaps just as alarming is that orders for possession and claims of possession on mortgaged properties are up 19% and 28% respectively.

This is, of course, a cause for concern and many homeowners will be hoping that they don’t add their property to this set of statistics.

There are things that can be done though, and in this blog, we look at how you can stop the repossession of your house and show you what the options are if a repossession may be imminent.

- What is a house repossession?

- What is causing people to face repossession?

- Stages of house repossession

- How can I stop a repossession?

- Understanding your rights to stop repossession

- What are the legal obligations of a lender if you are facing repossession?

- How does repossession affect you?

- Selling your house to stop repossession

- Debt advice

What is a house repossession?

A house repossession is when a property is taken back by the mortgage lender as a result of the mortgage not being paid. This is not an instant solution for them, and one missed payment will not see the house claimed back, but instead, if continual payments are missed, a lender can go to court to seek possession so they can sell it themselves and claim the money they are owed.

If the lender is successful in their application for the property to be repossessed, the residents will be given a date to either settle the debt or leave the property. If they do not, bailiffs can be sent to the home to force an eviction.

What is causing people to face repossession?

There are a variety of causes and perhaps the one we see referenced most often is affordability. Mortgages have been in the news a lot recently due to people seeing their payments jump by several hundred pounds per month, and whilst this does not happen to everyone, tracker rate and SVR mortgages that follow Bank of England rates can see payments change by the month, whilst fixed rates offer the stability of beating rate rises but can prove to be expensive when the rates fall. This means that with wages only moving upward slowly, people have less cash to pay the important bills.

Aside from general affordability due to the rates set by lenders, there are also economic factors that stem from unemployment, ill health, divorce, or emergency expenses for example. Should any of these events occur, clever fiscal management is required but sometimes, even the best brains cannot stretch the pounds far enough to cover everything.

Stages of house repossession

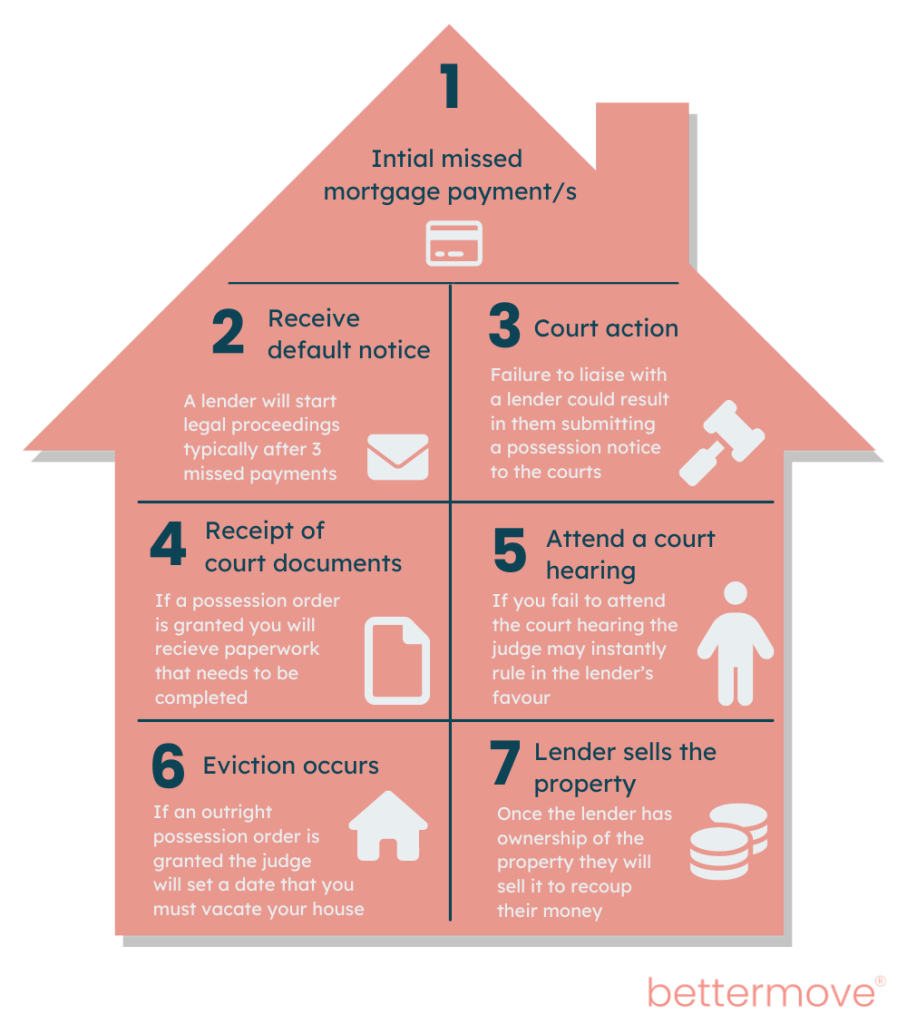

Repossessing a house isn’t a straightforward and fast process. It certainly won’t happen overnight. Lenders and the courts are bound by specific rules meaning a process must be followed before they can seize the property. This means you have opportunities to save your home if you are the one facing repossession.

First missed payments

If you have missed one or more payments, you are in arrears and now owe the lender money. This is where things can easily unravel as you could find yourself forever playing catch up. If you reach out to the lender before they contact you, there is every chance you can solve the problem before it escalates. You may be able to sort a payment plan whilst you organise your finances or make a lump payment to get things back on track. Doing this immediately will stop the process going any further. Leaving it though can set the wheels in motion for repossession.

You receive a default notice

The lender will send you a letter if you start to miss frequent mortgage payments. Whilst the letter may sound alarming, you have options. If the letter is received after missing one month of mortgage payments, the lender will in all likelihood offer you a payment plan or give you some time to make the payment. The Government states that all lenders must attempt to reach an agreement with you on how and when the missing payment will be made. This could be by extending your current agreement for example.

Should you receive a default notice for two months’ worth of missed payments, the lender will look to put a plan in place to get their money back, should it reach three months and you have made no effort to reach an agreement on paying back what is owed, the lender will likely begin legal proceedings. However, they must follow what is known as pre-action protocol. We cover this further down the page.

Court action

If the lender has attempted to contact you, negotiate a repayment plan, or offered assistance, and has been ignored, they will look to set out a plan to get their money back or take ownership of the property. They will do this by submitting a possession notice to the courts. They must follow specific steps to do this and provide you, in advance, with full information relating to how much is owed and what payments have been missed, as well as informing you that the repossession process is now starting. Within this same notice, they must also advise you to contact your local council should you potentially find yourself homeless due to the process.

Should the lender not follow those steps, you may find that a complaint to the Financial Ombudsman can help. This could see the lender having to pay your court fees and also devise a repayment plan.

Receipt of court documents

If the lender was successful in applying for a repossession order, you’ll receive various documents in the post that must be checked and completed where required. Without doing so, you could find yourself aiding the lender’s case substantially, and increase the chance of losing your home.

You’ll receive an N5, a form that indicates the particulars of the property, where the court case is due to be heard and the reasons for it happening. Within form N120, you’ll see details of the total mortgage value, how much has been repaid so far, what payments are missing and what the outstanding balance is. The N11M form allows you to detail all information relating to the case that may assist you. These should be reasons that have led to the mortgage arrears, information relating to any other debts you may be in and whether you are in the process of claiming or applying for any benefits.

Attending a court hearing

After receiving your letters outlining the case for the lender, you must attend the hearing. If you do not, you won’t be able to present a defence and the judge may instantly rule in the lender’s favour, stripping you of your home. Here, both the lender and you can present your cases. The lender, showing why a repossession is necessary, and you, why it is not. A judge will listen to both arguments, and you may use legal representation if you think it beneficial. During the repossession hearing, you will need to provide evidence showing how you plan to repay the debt. If this is deemed sufficient the judge might structure a repayment plan that avoids repossession.

You may also request that repayments are delayed so that you can secure the funds to clear the debt. This could be via a fast house sale to a cash house buyer for example. A cash house buyer can have the funds with you within a guaranteed timeframe, appeasing both the judge and the lender. It could also be via a new job. Be prepared though. The court and the lender will want to see proof of the house sale or the offer of the job to deem these as suitable defences. Your appearance in court will be looked upon more favourably if you can demonstrate that you are attempting to get back on track and have tried to find ways to correct the mortgage arrears. This proactive nature will see the law protect you and a judge more likely rule in your favour.

The decision

After hearing both sides, the judge will make a decision that may result in the repossession of your home or allow you to keep it. Should they determine a repossession is justified they will order it through an outright or a suspended order.

The outright order will hand ownership of the home to the lender and set a date for when you should vacate the property.

If they issue a suspended order, you will be allowed to remain in the property as long as you follow the exact terms set by the court. This will stop repossession but can be expensive. You’ll be paying your regular monthly mortgage costs, plus an additional amount to cover the arrears as well as court costs incurred by the lender.

If the lender has been found to have failed to follow procedures correctly, the judge will dismiss the case and likely even see that the lender pays your court fees.

The eviction

If the outright order was issued, or you have been seen to breach the terms of a suspended order, the lender will apply for a warrant of possession. This gives them access to the property and sees you evicted. You must be given at least 14 days’ notice with bailiffs issuing a notice that states a date and time when the property must be vacated. Even with your eviction though, you may still find that the repossession causes further financial turmoil.

The lender sells the property

Once the lender has been given ownership of the property, they must sell it for the best price to recoup their money. During the sales process, all your payments for the property cease and should it sell for enough money to cover what is owed, the legal fees of the lender, any maintenance costs and typical agent fees, you will owe nothing else.

Should the property sale not raise sufficient funds to cover the debt, a mortgage shortfall occurs, and you will still owe whatever the remaining balance is.

How can I stop a repossession?

If you notice you are falling behind on your mortgage payments, you can avoid all of the above by following a few simple steps. If you spend time thinking it will eventually resolve itself or can be fixed later, you are edging closer to losing your home. As soon as you become aware that a payment may not be made, or you anticipate there may be trouble ahead, you should do the following to stop repossession:

- Contact your lender: If you reach out to your lender before things get too complicated or worrying, you could find it allows you to keep your house. Lenders want to help you, it’s much easier to find a resolution between yourselves than go through the long court processes. Speak to them about your circumstances and it will be much easier to find a plan that works for you both. This could be new mortgage terms, an extended deal, a freeze on interest or something else. If you are facing just a temporary delay in making a payment, let them know. If you can give a set date when you can make the payment, it may stave off any further action. It should be noted that this is only likely to be an option if you have just missed one, or perhaps two payments.

- Request a change to the mortgage: You may be able to request a temporary or permanent change to your mortgage that helps you get back on track. This could mean lowering your monthly payments but extending the time to pay it back.

- Ask about a repayment plan: With most forms of debt, the lender is happy to get the money back, as long as they get it back. It’s those refusing to pay anything that cause additional cost and trouble. By offering a repayment plan, the lender will view you as more favourable than those choosing not to pay and may well accept your proposal.

- See if mortgage forbearance is an option: Some, but not all lenders, will be quite willing to be flexible to accommodate your needs. With forbearance, they may offer to freeze payments for a while, allowing you to get things in order before restarting payments.

Understanding your rights to stop repossession

Carrying out all of the above will certainly help either halt or slow down the repossession process but it’s important to know your rights.

- The right to information: Your lender must provide clear information relating to your arrears, your mortgage and any missed payments. They must also provide you with the relevant FCA documents and local authority information relating to potentially being homeless.

- The right to propose a payment plan: You have the right to propose how you plan to pay the arrears. Legally, your lender must consider these, if they reject them, they must inform you within 10 working days.

- The right to seek a delay for financial help: You have the right to seek a delay in action being taken if you are awaiting any form of financial assistance that could help you with the arrears. This could be through benefits, insurance payouts or if your situation is about to change. This delay can also be applied if you are receiving debt advice.

- The right to seek a delay for a home sale: Action may be getting taken, but you have the right to request a pause to proceedings if you are selling your home to clear the debt. The home must be sold at an appropriate, realistic price and you must allow both the chosen estate agent and the conveyancer to engage with the lender for full transparency.

What are the legal obligations of a lender if you are facing repossession?

If you have started to miss payments, the lender must provide you with opportunities to settle the situation. They will first send the default notice after you have missed the first payment. They must also, within 15 days, provide you with the most up to date money helper sheet. This will help give you guidance on the next steps and is completely impartial. At this stage, they are not allowed to put pressure on you or take ownership of the home.

The Mortgage Charter is also something that may be followed by your lender. Set up in 2023, if a homeowner misses a payment for the first time, they will be given a grace period of one year to remain in the home. If repossession has already begun, the charter can still protect you. However, not all lenders are signed up to it.

The pre-action protocol

If repossession processes have started, the lender still has an obligation to work with you to resolve the situation. They must follow what is known as “pre-action protocol.” This means that at all times, the lender must treat you fairly and without judgment, discuss your financial situation with you and give you a reasonable timeframe to clear any arrears. All potential options for paying back the arrears must be looked into before forcing repossession. This could mean extending the mortgage term, changing the mortgage type, or cancelling the interest for a period among many other potential solutions.

Furthermore, in addition to the N120 letter we mentioned earlier, the lender must also provide you with at least one of the following advisory notices:

- The FCA arrears information sheet

- The FCS default information sheet

- The NHAS Mortgage Arrears Guidance

Within the pre-action protocol, lenders must refrain from starting court proceedings if:

- You have made an insurance claim under a mortgage payment protection policy.

- You have proven to the lender that you can pay what is owed or pay any shortfall should the insurance policy not cover the full claim amount.

- You are about to receive a pay rise that helps cover your mortgage. Proof will be required.

- You have sought the help of a debt advisor to assist you.

- You have requested support from the council for a homelessness prevention scheme.

- You are taking proper steps to ensure the sale of your home at a realistic price.

- You have made a claim for Universal Credit or other suitable benefit.

- You have complained to the Financial Ombudsman Service about how the lender has dealt with you and your mortgage arrears.

How does repossession affect you?

Losing a home is a huge burden to bear. Not only do you lose the family home which can be emotionally, mentally, and financially draining but you also run the risk of seeing a huge impact on your personal life and day-to-day finances.

Loss of home

The loss of the home could very easily cause divisions in the family. Especially if young children are involved who don’t fully understand the circumstances. Align this with the burden you feel yourself and it can be a hugely demanding time emotionally.

You could also see your cherished items lost to repossession. There is a legal obligation whereby lenders must give a timeframe for items to be retrieved, however, should this pass, and items not be claimed, they can dispose of them.

Financial troubles

The reasons for the repossession likely stem from finances and should there still be outstanding amounts due after the lender has sold the property, you need to find some way to service that debt. This could result in selling heirlooms or essential items such as your car.

Repossession also illustrates poor money management. Sometimes, this is through no direct fault of your own. A job loss for example is significantly different to gambling your wages away. However, if you are seen to fall into debt that you cannot manage, your credit score takes a huge hit. This will stop your chances of securing a mortgage in the future, restrict your access to credit cards and see any future forms of finance either rejected or subject to high interest rates. Furthermore, even if you address the situation, these blemishes on your credit score can stay there for up to seven years!

Legal costs and stress of court

To help your case in court, you will likely pay for someone to act on your behalf, further adding to the money you now owe. Add in the stress of having your finances displayed for all to see and the repossession process adds both financial stress and mental stress significantly.

Accomodation prospects

With the chances of securing a mortgage quite low, renting may be the only option. Whilst this will not match the stress of buying a property, a landlord will assess credit history before accepting a tenant and may feel more comfortable rejecting an application from someone who has shown poor money management.

In many cases, a repossession sees the need to downsize, it will need to be determined just how small a house matches your needs before committing to anything.

Long term finances

You may have had grand plans to retire or help your children through university but with the proceeds of the repossessed house sale servicing the debt, you’ll have to start from scratch for accommodation which could eat into the money you had locked in funds for future use.

Selling your house to stop repossession

Selling your house can be the quickest way to avoid a repossession blighting your financial history. Depending on the route to sale you take, you may be able to satisfy the needs of the lender and leave yourself with some funds towards a new home. Unfortunately, the property market is known to be full of delays and the longer it takes to sell, the further into mortgage debt you may find yourself.

With the added legal costs associated with selling and the possibility of chain breaks, you could find the opportunity to sell is one that needs to be taken fast. That is where companies like Bettermove come in. We understand that your financial situation may not be at its best so we offer a completely fee-free service enabling you to sell your house for free, without fear of any surprise charges. With the ability to complete a sale in as little as seven days, we can help you satisfy the needs of the lender and see that you avoid costly court hearings and the stress of repossession. Our open and honest approach to sales allows you to remove the shackles of worry and instead put your focus where it needs to be, on you and your family. Contact us today to find out how we can help.

Stop repossession with a cash offer

"*" indicates required fields

Debt advice

If you’re struggling with mortgage payments or are facing reposession or homelessness there are a number of contacts below you can reach out to for help:

Stop repossession FAQs

"*" indicates required fields